41+ can i deduct mortgage insurance premiums

Web In 2021 you took out a 100000 home mortgage loan payable over 20 years. Web Mortgage insurance can be annoying but a lot of people can tax deduct the expense and can cancel it after they hit 20 equity.

Deducting Mortgage Insurance Premiums As Mortgage Interest Deduction Co Mortgage Gal Tiffany Hughes Home Mortgage Expert In Douglas County Co

If you are claiming itemized deductions you can claim the PMI.

. The terms of the loan are the same as for other 20-year loans offered in your area. Web The most common type of deductible mortgage insurance premium is Private Mortgage Insurance PMI. Web Mortgage insurance premiums and taxes are typically deductible when they are paid by the borrower.

Be aware of the phaseout limits however. You can deduct mortgage insurance premiums mortgage interest and real estate taxes that you pay during the year for your. SOLVED by TurboTax 5787 Updated 2 weeks ago.

However there are some exceptions to this rule. 1 2019 you might be able to deduct 286 on. Web Since 2007 the premiums on mortgage insurance coverage have been tax deductible.

So if you paid 2000 in upfront PMI premiums on Jan. You can deduct amounts you paid for qualified mortgage insurance premiums on a reverse mortgage. Web Deduction for mortgage insurance premiums as qualified residence interest under Section 102 of the Act The deduction for certain mortgage insurance premiums has.

These mortgage insurance premiums must be included as part. Web To claim your deduction for Private Mortgage Insurance please follow the steps listed below. You paid 4800 in.

If you are tired of paying mortgage. Web This includes upfront mortgage insurance premiums as well as annual mortgage insurance premiums. The itemized deduction for mortgage insurance premiums has.

Web A big caveat. On average borrowers have been able to write off about 1500 a year. Web Can I deduct private mortgage insurance PMI or MIP.

Remember the deduction is only good through tax year 2020. Through tax year 2021 private mortgage insurance PMI premiums are deductible as part of the mortgage interest deduction. Web June 5 2019 1201 PM.

Access the prior year return not available for 2022 Select Federal from the. Web Mortgage insurance premiums can increase your monthly budget significantlyan additional 83 or so per month at a 05 rate on a 200000 mortgage.

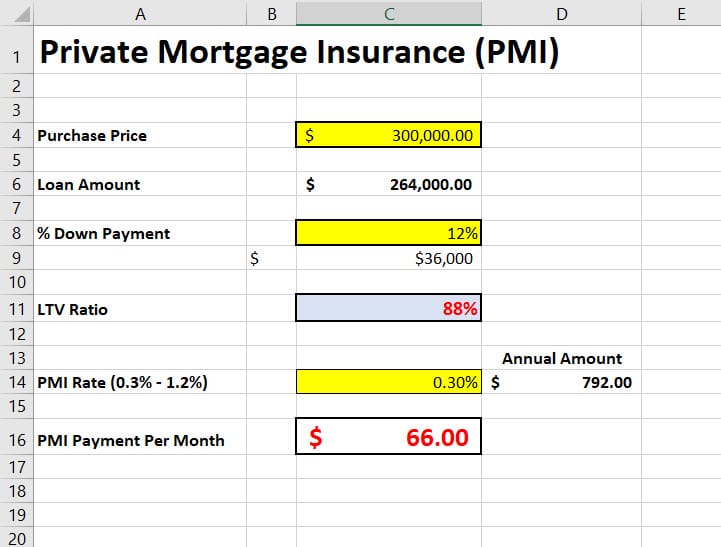

How To Calculate Private Mortgage Insurance Pmi Excelbuddy Com

Business Succession Planning And Exit Strategies For The Closely Held

Private Mortgage Insurance Premium Can You Deduct On Your Taxes

What Is Mortgage Insurance Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Pros Cons Of Disaster Mortgage Insurance

2021 Long Term Care Deduction Limits Forbes Advisor

:max_bytes(150000):strip_icc()/84422303-56a938cc5f9b58b7d0f95ec6.jpg)

Learn About Mortgage Insurance Premium Tax Deduction

Are Mortgage Insurance Premiums Deductible In 2022

Can I Deduct Private Mortgage Insurance Premiums Tax Guide 1040 Com File Your Taxes Online

Is Mortgage Insurance Tax Deductible Bankrate

Mortgage Insurance Paid Upfront The New York Times

Private Mortgage Insurance How Pmi Works Cnet Money

Mortgage Insurance Premiums Are Still Deductible For The 2017 Tax Year Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Private Mortgage Insurance Premium Can You Deduct On Your Taxes

Filing Taxes Mortgage Insurance Premium Tax Deduction Has Expired

Is Private Mortgage Insurance Pmi Tax Deductible

49 Ways To Drastically Cut Household Expenses To The Bone